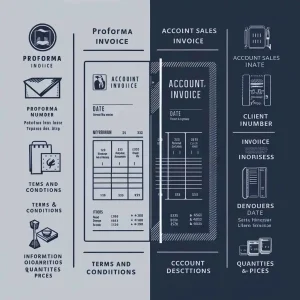

The Difference Between Proforma Invoice and Account Sales

Wading through the terminology in the extensive realm of business transactions is not a walk in the park. Two terms that are quite common are Proforma Invoice and Account Sales. They are basically associated with sales and financial activities; however, it is necessary to distinguish the specific differences. It is time to travel to explore these ideas and shed light on the difference between them.

Exploring Proforma Invoices

A seller provides a Proforma Invoice to a buyer before delivering goods or services. A prelude to the grand sale, in effect and can be best described as a teaser trailer to the final deal. It contains information that includes the following: name of the item, quantity, price and suggested sale condition. However, what must be understood is that a Proforma Invoice differs from a final invoice in a way that it is not an invoice that demands payment.

Deciphering Account Sales

Account Sales relates to the sale of goods or services on credit, where businesses sell products or services with an intention of being paid for later. This structure entails the formation of an account of the buyer and then make purchases on strength of credit conditions. Usually the concept of account sales is present in b2b scenarios, which creates a long-term partnership of cooperation.

Critical Differences Between Proforma Invoice and Account Sales

Proforma Invoice:

- Preceding Document: It comes before the actual sale as a forecast or offer.

- Non-binding Nature: As a result of this, it does not have legal enforcement power like the final invoice that compels the buyer to make payment.

- Customs Compliance: Commonly used in foreign trade to provide full information about the shipment to the customs services.

Account Sales

- Credit Transactions: Is defined as selling of goods or services with an expectation to be paid at a later date.

- Establishment of Credit Terms: This involves creating a buyer account or patent for the identity and payment logistics to be made on the buyer account.

- Legally Binding: Points to a particular product or service and also include provisions of how payment will be made.

Unveiling the Importance of Proforma Invoices

Proforma invoices in general are indispensable instruments of business and especially in transactions between countries. They supply the buyers with relevant information on forecasts of transactions to be done in the near future in relation to receiving shipments and making fixed payments. Additionally, proforma invoices reduce risks by constructing a precise picture of the type of transactiion intended to be undertaken and thus avoiding confusion.

Benefits Encompassed in Account Sales

The selling of accounts have many benefits for both the buyers and the sellers on the market. Purchasing involves flexibility regarding the cash flows; this implies that purchasers can afford to purchase products without necessarily dig into their pockets immediately. On the other hand, for sellers, account sales build customer loyalty and build long-term strong relation with the business clients, promote future business with those accounts. Furthermore, the policy of crediting can provide a competitive advantage in the context of the market environment.

Strategic Utilization of Each

- Proforma Invoice: Use when producing quotations for goods or service to be exported, especially when the items require customs clearance.

- Account Sales: Use where credit relationships with clients or customers are active e.g. in B2B where credit terms prevail.

Illustrative Examples of Proforma Invoices

- Export Transactions: Sending an electronic message with information about a transaction between a buyer and a seller before exporting products.

- Tailored Orders: Giving a proforma invoice to a client in case of an acceptable offer on a localized product or service. Under Practical Examples of Account Sales,

- Wholesale Transactions: Undiscounted selling of products to retailers where the retailers are themselves bound to pay the amount later.

- Service Agreements: Expanding most outreach access to clients with predetermined payment structures agreed upon prior. The following paper aims to discuss existing myths regarding racing as well as to provide some relevant facts.

- Proforma Invoices are Conclusive: Proforma invoices may look like an actual invoice but they are not legally enforceable document and consumers do not have to pay for it immediately.

- Risk Perception of Account Sales: Nonetheless, account sales come with non-payment risk and this, due to standard assessment of credit and risk management measures can be well addressed.

Conclusion

For that reason, knowing the difference between proforma invoices and account sales will help the stakeholders make sense of business since both are parts of contractual relations. By recognizing such inequalities business can be able to Kristakis in the global business society so as to construct sound bargaining relations with the clientele.

Frequently Asked Questions

That part of the agreement which took the form of a proforma invoice was not legally binding, but was it valid?

Proforma invoices are used as quotations and as such they have no legal force in making the buyers pay for the products offered.

How can sales of accounts improve cash profiles of businesses?

However, the product sales also give the company the ability to avoid outright payments, helping to build short term reserves.

That leads to the next questions- What risks are involved in account sales?

The clients are the main source of risk in account sales; however, these risks can be managed through the conduct of credit check and risk management frameworks.

How many of the businesses that we have in the market offer account sales?

Well, let it be mentioned that the decisions on the account sales depend on the type of business and the desires of customers and merchants.

What is the distinguishing factor between the proforma invoices and the normal invoice?

While proforma invoices arent legally enforceable and do not formalize the transaction prior to invoicing, business organizations create regular invoices after the occurrence of the transactions with a purpose to claim payments.